Rules of thumb are common in the investment world. There’s the “rule of 72”, which gives us an idea of how often money will double. The safe retirement withdrawal rate lets us know how much we can “safely” draw from retirement portfolios without significant risk of long-term depletion.

Finally, there is the your age in bonds rule, telling us how much of an investment account should be in fixed income at a given time.

As with any rule of thumb, these are rough approximations that are designed to communicate a complex topic in more simple terms. However, I find the your age in bonds rule to be somewhat problematic. If followed over the life of an investor, this approach may undermine your ability to retire.

The your age in bonds rule is relatively simple. Whatever your age is, that’s what percent of your portfolio should be in fixed income (bonds) with the rest being in equities (stocks). So, under this methodology, a 45-year old’s retirement portfolio would be allocated 55% to equities and 45% to fixed income.

Let’s take a step back and consider what the purpose of equity and fixed income are in a portfolio. We primarily employ equities to grow principal, with income from dividends being a secondary benefit. Over the long-term, we feel equities have a greater chance of producing excess returns when compared to fixed income or cash.

Growth of Wealth Over 25 Years – 1/1/1992 to 12/31/2016

Source: Dimensional Fund Advisors as of 12/31/2016. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Performance data shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown.

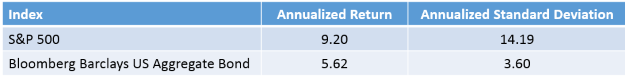

On the other hand, the role of fixed income is to produce current income for a portfolio and to serve as a volatility dampener to lower the portfolio’s overall risk. Indeed, the long-term, historical behavior of these asset classes support this line of thought.

Return & Risk Figures Over 25 Years – 1/1/1992 to 12/31/2016

Source: Dimensional Fund Advisors as of 12/31/2016. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Performance data shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown.

So, what’s the problem with the your age in bonds rule, exactly? Well, many of our first experiences with investing were with a company 401(k), fresh out of college. The average 22-year old is probably staring down about 45 years of work before retirement.

Our handy rule of thumb would dictate that this young worker’s retirement portfolio should be allocated 78% to stocks and 22% to bonds. By age 40, that portfolio would be 60% stocks and 40% bonds (with 27 years still to go before retirement). By the time we finally reach retirement age, our portfolio is 33% stocks and 67% bonds.

In all of these cases, the objective risk profile of these portfolios do not match the time horizon of the investor. Ultimately, they will need a portfolio that is designed to grow over a 45 year work-life and then continue to provide income in retirement for another 25-or-so years.

This is a 70 year investment life. By employing a portfolio with a lower expected returns throughout your life, you will have likely have less assets available for use later.

There are a couple of reasons why the your age in bonds rule might have been reasonable in the past, but doesn’t carry water today. Prior to the turn of the century, bonds yielded much more than they do now.

According the US Treasury Department, in 2000, ten-year treasury bonds yielded approximately 6%. Today, they hover around 2.5%. Earning a relatively stable 6% on your fixed income holdings can go a long way in a portfolio, whereas sub-3% will not.

Because of the global financial climate, we cannot rely on the income from bonds to carry us through retirement the way we used to.

Furthermore, we are all living longer. In order to support extended longevity, our portfolios need to continue to grow in retirement to combat the effects of inflation and rising medical costs.

If the your age in bonds rule doesn’t work, then what’s the “right” allocation? Age minus 10 in bonds? Age minus 20? If you look at the objective inputs that are considered in portfolio construction, then somewhere around age minus 15 or 20 is probably most appropriate.

But, this is where a rule of thumb breaks down, a bit. They’re great for doing quick math in your head. They’re not so great for executing an investment strategy over your lifetime.

Any strictly age-based allocation misses myriad, important considerations that go into creating an appropriate investment portfolio. Factors such as your own risk aversion, your income sources now and in the future, personal health and longevity factors, and your individual goals all need to be considered when designing a portfolio. Age is just one, small factor in the equation.

There is one positive takeaway from the your age in bonds rule. Most investors should be reducing their risk as their investment time horizon declines. A 22-year old typically has more capacity for market declines than a retiree. An appropriately allocated portfolio should reflect that.

We manage portfolios and construct financial plans for clients. At Ferguson-Johnson Wealth Management, our team of advisors and planners help you make appropriate decisions with your assets. We’ll review your portfolios, free of charge, and let you know whether you’re on the right track. Schedule a free consultation today!

If you’re looking for a wealth manager and financial advisor that puts you first, call Ferguson-Johnson Wealth Management today!

CONTACT US