Diversification is hailed as “the only free lunch on Wall Street”, based on the famous quote by Harry Markowitz. Some of us accept this as a fact and take a diversified approach to our portfolios.

Then, a stock our buddy picked quadruples its value or the S&P 500 outperforms other asset classes over a multi-year period (as we’ve seen in the last few years). In times like these, it is easy to lose sight of why diversification is so important.

Diversification is the idea of not putting all your eggs in one basket. This applies, not only to individual stocks (so, not putting all your money into Apple or Amazon), but to asset classes as well (not putting all your money in U.S. large companies).

Despite its impeccable performance over the past three years, it is probably unwise to park all of your money in the S&P 500. Diversification means investing in U.S. small cap companies, international equities, emerging markets, real estate, and fixed income, too.

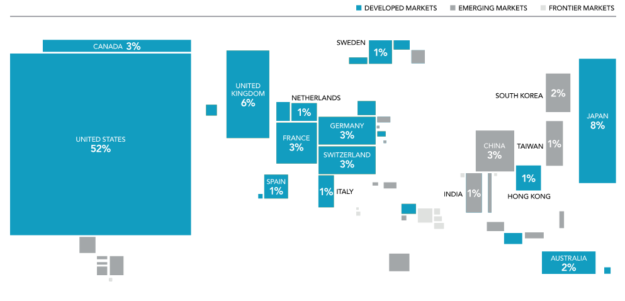

While the United States is a titan in the global economy, it only constitutes about half of the world’s equity markets. Limiting your equity exposure to a subset of the U.S. market will then ignore most of world’s equity markets.

Source: Dimensional Fund Advisors. Market cap data is free-float adjusted from Bloomberg securities data. Many nations not displayed. Total may not equal 100% due to rounding. China market capitalization excludes A-shares, which are generally only available to mainland China investors.

Think about a few stocks that are in the S&P 500: Apple, GE, ExxonMobil, Amazon, and Verizon. These U.S. large cap stocks may be involved in different industries, but all are subject to the same legislative environment and economics that affect large cap stocks in the United States. As the U.S. economy ebbs and flows, so too will these companies. They are highly correlated.

As you spread your investment exposure across dissimilar asset types and add securities that are less correlated to your portfolio, you can reduce your overall risk.

Market events that may adversely impact companies in the S&P 500, may not affect companies that make up the MSCI EAFE Index (an index representing large, non-U.S. companies from developed countries).

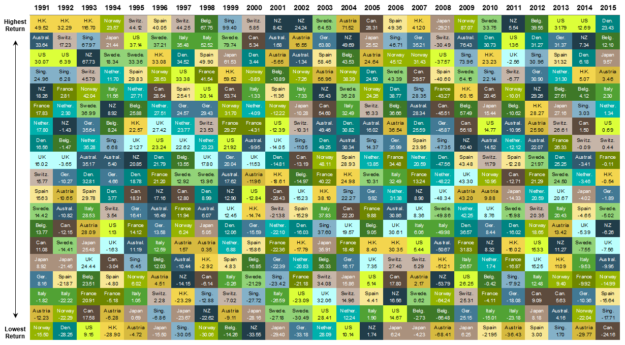

The performance of one country’s companies compared to another’s can be wide ranging. History has shown that there is no reliable way to predict that an asset or country is more or less likely to outperform in a given year. The chart below orders each country’s returns, from best to worst, over the last 25 years.

Source: MSCI developed markets country indices (net dividends) with at least twenty-five years of data. MSCI data © MSCI 2016, all rights reserved.

As you can see, top performers in a year have a seemingly random result in the subsequent year. Sometimes they continue to perform well, sometimes they are losers, and other times they are in the middle of the pack. Trying to base decisions about how to allocate assets based on past information is fruitless.

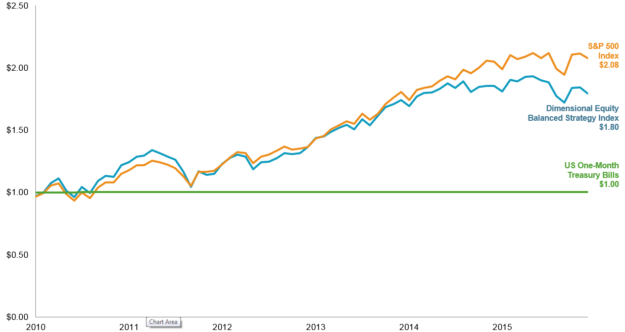

Some may be quick to point out that since the beginning of the decade, the S&P 500 has been one of the strongest performing asset classes in the world.

Indeed, if you had held just the S&P 500 since the beginning of 2010, you would have likely out-performed an index with a broader exposure. See explanation of Dimensional Equity Balanced Strategy Index.

In US dollars. Sources: Dimensional for Dimensional Index data. See “Dimensional Equity Balanced Strategy Index Description” page for more information. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. The S&P data is provided by Standard & Poor’s Index Services Group.

As you can see above, the S&P 500 has slightly out-performed a more diversified portfolio over the past six years.

Stagnant growth and economic crises abroad combined with favorable timing from market growth following the Great Recession have fuelled excellent returns from U.S. large cap companies, so far in this decade.

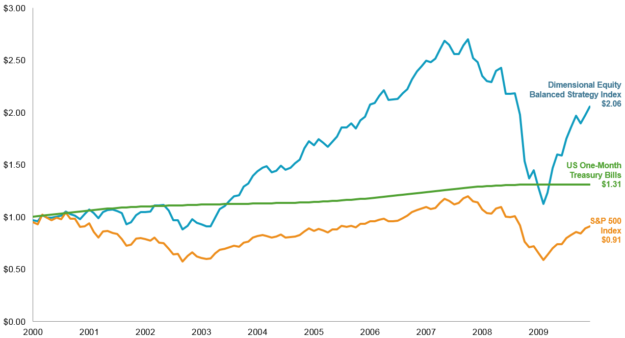

However, if we look at the same portfolios from 2000-2009, there is an entirely different story to be told:

In US dollars. Sources: Dimensional for Dimensional Index data. See “Dimensional Equity Balanced Strategy Index Description” page for more information. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. The S&P data is provided by Standard & Poor’s Index Services Group.

Holding the S&P 500 over this 10 year period would have resulted in a loss. This period is commonly referring to as “the lost decade” which saw the S&P 500 decline over a ten-year period.

However, if we look past U.S. large cap equities, conditions were more favorable for globally invested investors. A more balanced portfolio could see our money more than doubling over this period of loss for the S&P 500.

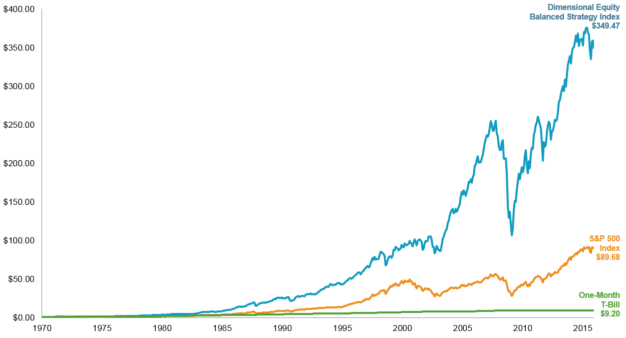

Furthermore, if we take a longer-term view of these indexes, we can see that a diversified index has been able to significantly out-perform the S&P 500:

In US dollars. Sources: Dimensional for Dimensional Index data. See “Dimensional Equity Balanced Strategy Index Description” page for more information. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. The S&P data is provided by Standard & Poor’s Index Services Group.

It’s easy to have a “what have you done for me lately” attitude about investing. Many investors chase around past winners to disappointing results.

For most investors, we believe a disciplined, diversified portfolio can be considerably more effective at meeting their needs. By allocating assets across multiple asset classes, investors are positioned to capture returns wherever they occur.

Illustrations and charts above are for educational purposes; should not be used as investment advice. Diversification does not eliminate the risk of market loss. Past performance is not a guarantee of future results.

Once you determine that it might be time to work with a financial advisor, it’s important to find the right advisor for you and your family. We’ve put together a guide of questions that are essential to ask an advisor before you hire them.

20 Questions to Ask a Financial Advisor

Don’t make a mistake by working with the wrong financial advisor. Ask the right questions the first time to determine if a financial advisor is right for you.

If you’re looking for a wealth manager and financial advisor that puts you first, call Ferguson-Johnson Wealth Management today!

CONTACT US