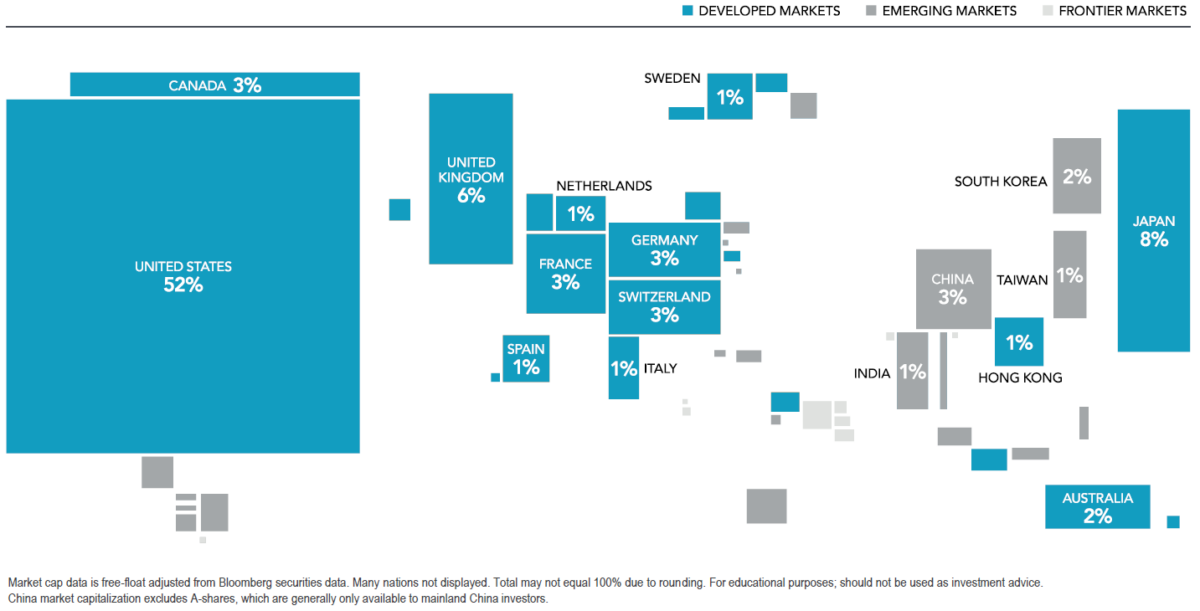

I often come across interesting images or thought-provoking data that I want to share with our community, but may not dictate 1,000+ words on the subject. Today, I want to launch a new series that explores these fun-facts in more bite-sized pieces. Click the image above for an expanded view.