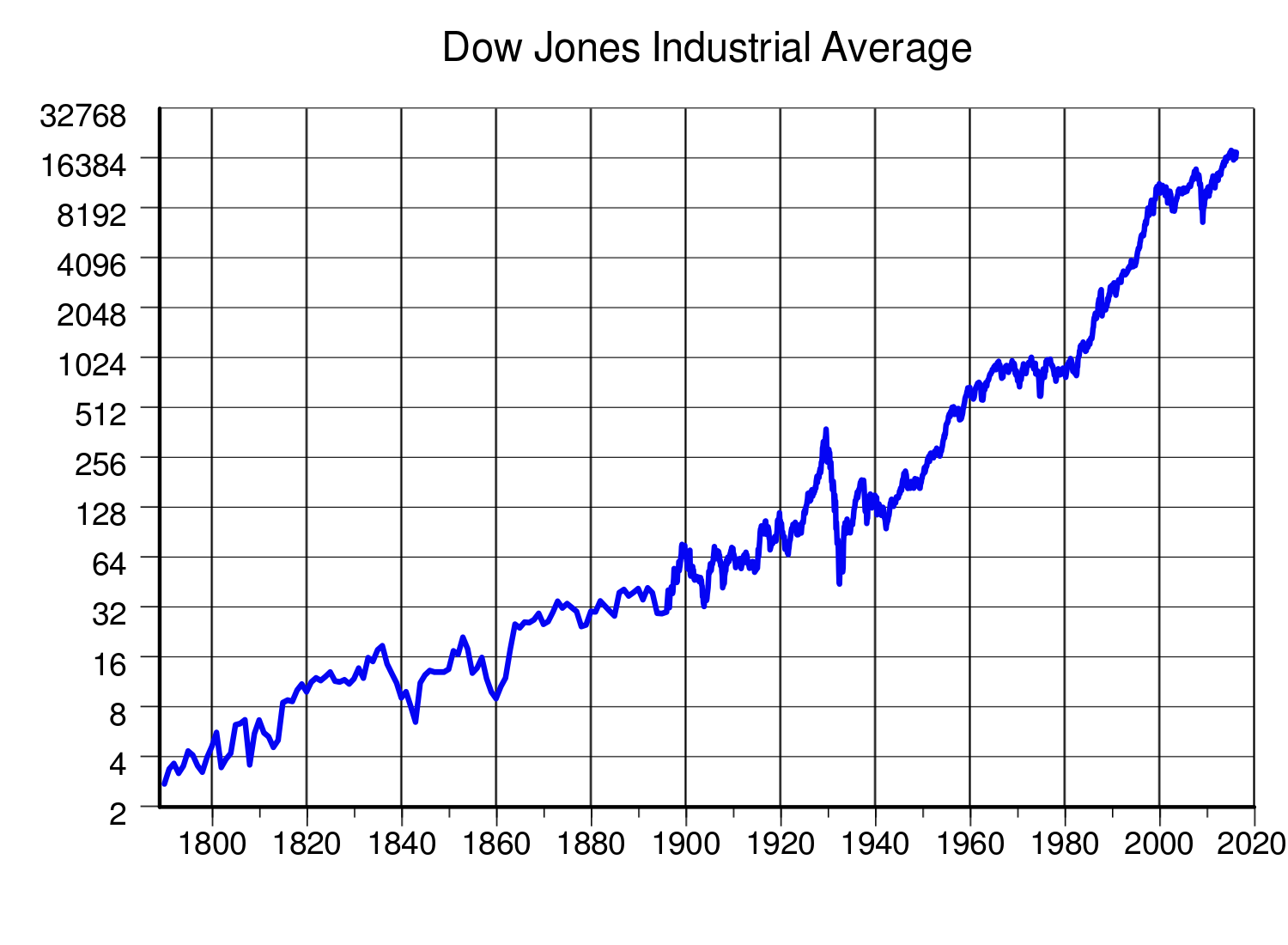

Last week, the Dow Jones Industrial Average (“The Dow”) cracked the 20,000 point mark. It’s fun and exciting, and it’s seemingly and indication that the stock markets and economy are doing well. Or at least that’s what financial media purports.

So, what does the Dow reaching this level actually mean? Well, in truth, very little. The Dow, as a benchmark, is an archaic, arbitrary bellwether of the US economy. The Dow is a bad index.

The Dow hitting 20,000 doesn’t mean we’re at the top. It also doesn’t meant that we’re poised to go higher. It literally means absolutely nothing.

Today we’re going to get into the weeds about what The Dow, and other indexes, actually are and why we use them.

The Dow is composed of 30 U.S. companies representing different industries that are seen as ‘blue-chips’ of the American economy. These are large, stable companies that you would be familiar with such as Coca-Cola, Visa, and Disney.

A weighted-average (based on price – more on that later) of the performance of these companies, day-to-day, yields the performance of the Dow as a whole. On a given day, Microsoft might be up 3%, Nike down 5%, Verizon up 8%, and General Electric flat. In aggregate, the Dow may have inched up 0.25% that day.

What the Dow, and all indexes for that matter, seeks to do is quantify how a market is moving, as a whole. The Dow doesn’t actually accomplish this very well because it is a price-weighted index.

In the world of indexes, there are price-weighted indexes and market-weighted indexes.

In a market-weighted index, the percentage share a company has in the index corresponds to its size relative to the market. For example, if you add up the total market value of all 500 companies in the S&P 500, Apple’s value is equal to 3.29% of the whole.

Therefore, Apple’s gets assigned a weighting of 3.29% in the S&P 500 index. It’s simple and straightforward. This methodology offers investors an accurate barometer of the aggregate performance of the market it tracks.

Price-weighted indexes, like the Dow, do not afford investors the same calculus. A price-weighted index assigns weighting based on the dollar value of one share of stock of the company. So, a company that’s share price is $100 would have ten times the weighting of a stock that’s share price is $10.

As an example, let’s consider ExxonMobil and Boeing, two components of the Dow. As of this past Tuesday, the price of one share of Boeing stock was $165.14 and one share of ExxonMobil Stock was $84.20.

For simplicity, I will equate their price as 2:1. To contrast this, let’s look at the size of both of these companies. Boeing is worth $101 billion and ExxonMobil is worth $349 billion1.

Despite ExxonMobil being more than three times larger than Boeing, the price movement of Boeing has twice the impact of the price movement of ExxonMobil in the Dow index, and this isn’t even the most egregious example.

So, why then do financial news outlets, your brother-in-law, and even your financial advisor insist on talking about how the Dow is doing? Well, for one, most people don’t understand index construction as I described above.

Rather than giving an exhausted lecture on market capitalization (as I just did) it’s easier to just reference the thing people think they know. On most days, the performance of the Dow and the S&P 500 are similar enough that it doesn’t matter.

Ultimately, the Dow’s prominence is a bad accident of financial history and is too entrenched to do away with. If you are actually curious about how the US economy is doing on a given day, month, or year, use the S&P 500.

There’s a lot to consider when investing, and figuring out how to have the best portfolio in a constantly changing market can be tough. At Ferguson-Johnson Wealth Management, our team of fee-only fiduciary advisors is here to help you make your investment decisions—whether you’re just getting started or you just need some advice. Contact us today for a free consultation!

1 Source: Yahoo Finance, as of 1/30/2017.

Once you determine that it might be time to work with a financial advisor, it’s important to find the right advisor for you and your family. We’ve put together a guide of questions that are essential to ask an advisor before you hire them.

20 Questions to Ask a Financial Advisor

Don’t make a mistake by working with the wrong financial advisor. Ask the right questions the first time to determine if a financial advisor is right for you.

If you’re looking for a wealth manager and financial advisor that puts you first, call Ferguson-Johnson Wealth Management today!

CONTACT US