Next week, Americans will head to the polls for the Presidential Election. Right now (and likely continuing for the next several months) there are prognosticators on every major financial network trying to predict how the market will perform in the short and long term under either Presidential candidate.

We caution clients and investors to not make significant changes to their long-term investment plan based on these predictions.

As I’m sure readers are aware, we believe in the efficiency of capital markets. Current market prices offer up-to-the-second looks of all of the available news and expectations about the companies in the market.

The price of a stock already reflects the assumptions the market has of our Presidential candidates. While unanticipated events may cause ripples in the markets, the magnitude and direction of movements from unexpected events cannot reliably be predicted.

While we advocate a long-term perspective when investing, we understand it is human nature to be concerned with the short-term happenings of the markets. So, how do the short-term effects of a Presidential election play out in the market?

The graph below plots the monthly returns in stacks representing 1% increments of the total returns for the S&P 500 from January 1926 to June 2016.

Each gray line represents a non-election month. Each blue line represents a month featuring Democratic victory in the presidential election, and red line for a Republican victory.

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. The S&P data is provided by Standard & Poor’s Index Services Group.

This chart illustrates that there seems to be little correlation between the instance of an election, or the winning party, having a particular effect on returns in that month.

But, what if we took a look at the years of and following presidential elections, once investors have had time to digest their candidates and outcomes? The following chart shows the returns of the S&P 500 Index in the year of an election (gray) and the year following an election (green).

Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Actual returns may be lower. Source: The S&P data is provided by Standard & Poor’s Index Services Group.

Here we see that, despite several runs of positive or negative performance, there is little evidence to support market timing decisions in the future, based on Presidential candidates or election results.

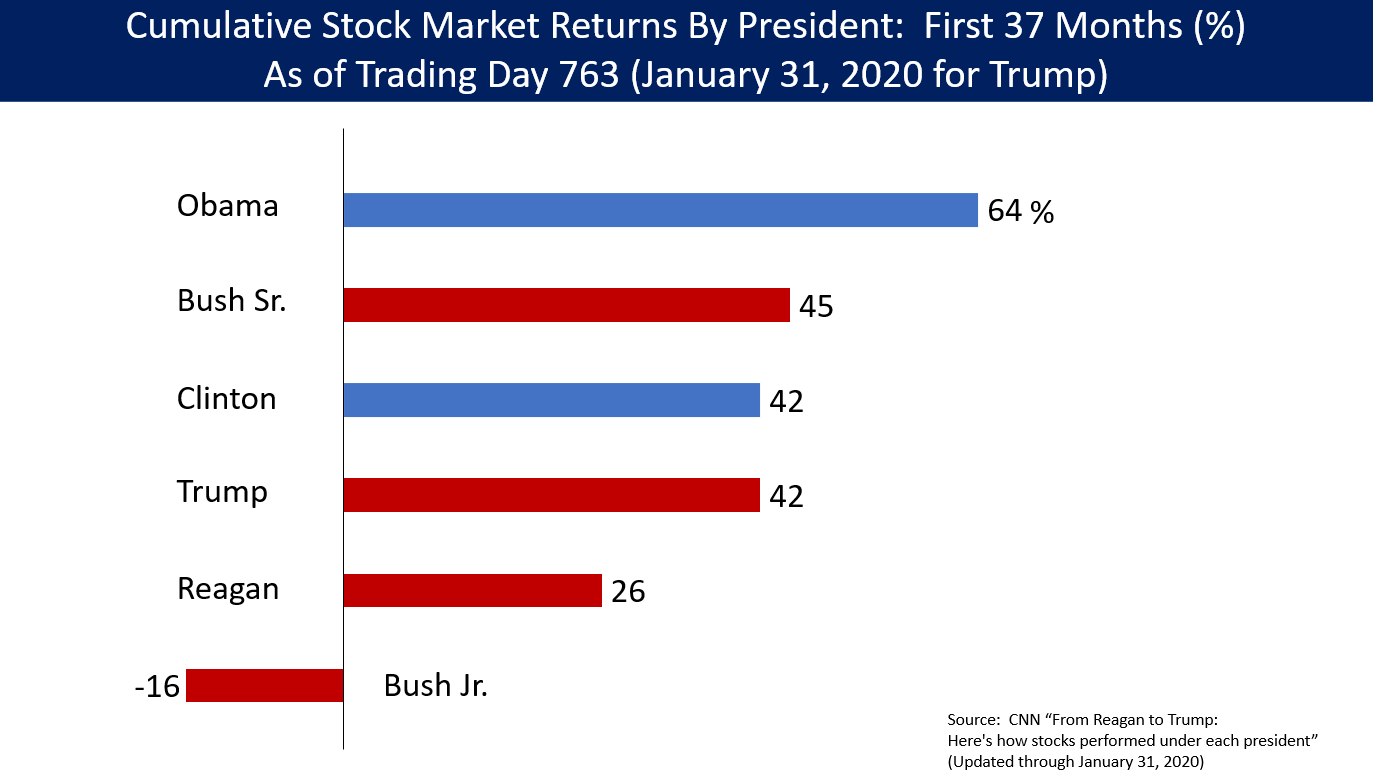

Those of us who are not concerned with short-term volatility may try and look for advice on how markets may be affected by a President over a more extended time period. We hear people talk about which candidate is “better for the markets”. So, is there an indication that over a presidency one party is more effective than another?

The graph below shows how $1, invested in the S&P 500 Index, has performed over 15 presidencies (90 years).

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. The S&P data is provided by Standard & Poor’s Index Services Group.

This data does not seem to show a discernible pattern of long-term stock market performance based on which party controls the Executive branch of our government. What we can see is that, over the long run, the market has provided significant returns regardless of the party that sits in the oval office.

I know we harp on this a lot, but we believe investing is a long-term endeavor. Trying to outguess the market, based on something like the Presidential election, is unlikely to produce excess returns. We advocate patience combined with proper portfolio construction and asset allocation, as opposed to trying to beat the markets.

Once you determine that it might be time to work with a financial advisor, it’s important to find the right advisor for you and your family. We’ve put together a guide of questions that are essential to ask an advisor before you hire them.

20 Questions to Ask a Financial Advisor

Don’t make a mistake by working with the wrong financial advisor. Ask the right questions the first time to determine if a financial advisor is right for you.

If you’re looking for a wealth manager and financial advisor that puts you first, call Ferguson-Johnson Wealth Management today!

CONTACT US