Saving for retirement ends up being a primary goal for many people during their working years. Worrying about when and if we can retire leads to many sleepless nights. Having an idea of how much you need, and whether you’re on track, can help alleviate some of these worries.

Let me get this out of the way first: Everything below operates on the assumption that you are investing in a diversified portfolio, that is allocated globally, and appropriate for your age, goals, and risk-tolerance.

If your money is just sitting in cash, or if you are jumping around trying to strike gold with the next hot stock or industry, the advice below won’t matter. The foundation of a successful retirement is the proper management of your nest egg.

In retirement, our goal is to be able to afford our lifestyle and not run out of money. In a perfect world, we’ll even have a little left over to help our kids after we’re gone.

As an advisor, my starting point for determining how much money you need in order to retire begins with how much you want to spend when you retire.

There are a lot of variables that go into spending. Tracking your cash flows and keeping a proper budget can help simplify this. Some expenses, like your mortgage, are significant drains throughout your working years, but are often paid off by retirement.

Other expenses, such as travel and hobbies, typically increase in the first several years of retirement as you grapple with a sudden abundance of free time. Getting an honest, complete look at your projected expenditures is step one.

In previous generations, retirement was supported by the three-legged stool of Social Security, pensions, and savings. However, in 2016 we’re looking at more like a one-and-a-half-legged stool.

Pensions have all but gone extinct for anyone under the age 50 and Social Security benefits are increasingly looking as though they will be a fraction of what was promised.

For a simple example, let’s assume we’ve decided that a couple is expecting to spend about $100,000/year in retirement.

Twenty years ago, our sources of income might have been: Social Security: $50,000, Pension: $35,000, and income from savings: $15,000. Today projections for those numbers are more likely to be: Social Security: $30,000, income from savings: $70,000.

Since our personal savings have become a much greater piece of the pie, we need a lot more money in the bank than our parents and grandparents did.

In order to arrive at a number, we’re going to use a common rule-of-thumb advisors employ to give clients and idea of what they need.

Based on significant research from our peers in the advising community, we generally feel confident that our clients can withdrawal 4% of their portfolio on an annual basis without significant risk of depleting their assets over the long term.

This obviously takes a number of assumptions for granted and your actual safe withdrawal rate may be higher or lower, depending on your specific circumstances.

For our example above, we need to come up with $70,000/year in income from our retirement savings. If we can only withdraw 4% of our portfolio to get there, this means our portfolio needs to be valued at $1,750,000, in today’s dollars.

Unfortunately, the key words from the previous paragraph were “in today’s dollars”. If we are several years from retirement, that target of $1,750,000 will increase quite a bit by the time our retirement date comes around.

If we use a middle-of-the-road assumption for inflation of 3% per year, that $1,750,000 increases to $2,352,000 for an individual ten years away from retirement. The further you are from retirement, the more this number will grow.

If you’re realizing that you’re short of your goals, there are some strategies you can employ to help:

1. Pay yourself first – Maximize your contributions to your 401(k) and to a Traditional or Roth IRA. For 2016, you can defer up to $18,000 per year to a 401(k) plan (and additional $6,000 if you’re over 50). You can also kick in $5,500 per year to an IRA, outside of your employer’s plan.

2. Suffer, a little – Saving isn’t supposed to be easy. If you can’t quite get to the point of maxing out your retirement accounts, save enough so that you’re just a bit uncomfortable.

Forcing yourself to be frugal because you’re contributing more toward your retirement can lead to curbing some of your more unnecessary spending habits.

3. Start early – For the younger crowd that may be reading this post, time is on your side. A dollar saved today, and invested properly, could be worth much, much more by the time you retire.

If the numbers above seem large, you may be surprised by the growth that can be achieved by your savings.

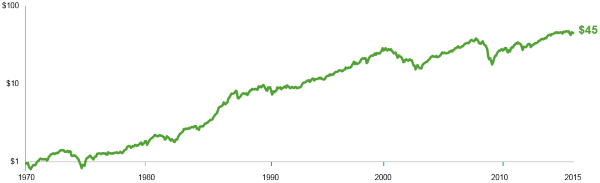

The chart below shows the growth of $1 in the MSCI World Index from 1970-2015 (a 45-year period, similar to a typical individual’s working life).

By exhibiting disciplined, long-term focused investing, it has not been difficult for individuals to create wealth. But, you must commit to saving in order to have money to grow.

Once you determine that it might be time to work with a financial advisor, it’s important to find the right advisor for you and your family. We’ve put together a guide of questions that are essential to ask an advisor before you hire them.

20 Questions to Ask a Financial Advisor

Don’t make a mistake by working with the wrong financial advisor. Ask the right questions the first time to determine if a financial advisor is right for you.

If you’re looking for a wealth manager and financial advisor that puts you first, call Ferguson-Johnson Wealth Management today!

CONTACT US