I often come across interesting images or thought-provoking data that I want to share with our community, but may not dictate 1,000+ words on the subject. Today, I want to launch a new series that explores these fun-facts in more bite-sized pieces. Click the image above for an expanded view.

How do we measure the world? Thinking only in terms of landmass or population can distort investment decisions. Directly comparing the markets of nations produces some surprising results. Measures such as population, gross domestic product, or exports do not directly indicate the size or suitability of investments in a market.

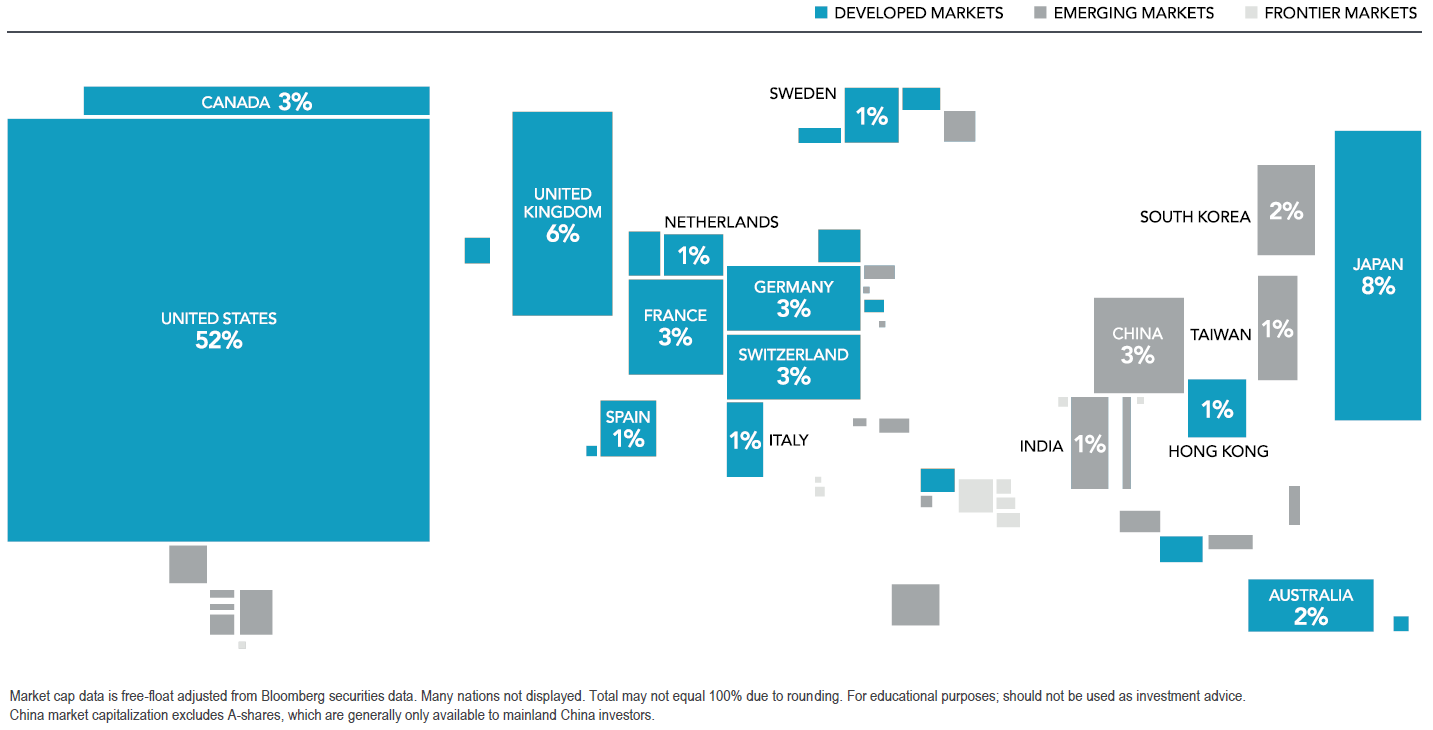

This cartogram illustrates the balance of equity investment opportunities around the world. The size of each country has been adjusted to reflect its total relative capitalization1. Ultimately, this illustrates how the world market cap breaks down.

Of course, the world is in motion—there is no fixed relationship between markets, and their proportion can change over time. Viewing the world this way brings the scope of diversification into new light and helps clarify allocation decisions.

Despite the impressive performance of domestic stocks in recent years, focusing all of your investments at home ignores about half of the equity opportunities of the market. So far, in 2017, markets outside the United States have fared quite well.

In fact, when comparing the indexes of domestic stock markets with that of developed and emerging international markets, the U.S. is currently the laggard2.

I went deep on diversification a few months ago. Most investors benefit from a diversified portfolio when it comes to saving for goals like retirement. We’re happy to talk to you about simple moves you can make to better position your assets for your goals.

1A country’s equity market capitalization, or market cap, reflects the total value of shares issued by all publicly traded companies and is calculated as share price times the number of shares outstanding.

2Source: Morningstar, as of 2/22/17. Indicies compared are the S&P 500 index, MSCI ACWI ex USA index, and MSCI Emerging Markets Index.

Once you determine that it might be time to work with a financial advisor, it’s important to find the right advisor for you and your family. We’ve put together a guide of questions that are essential to ask an advisor before you hire them.

20 Questions to Ask a Financial Advisor

Don’t make a mistake by working with the wrong financial advisor. Ask the right questions the first time to determine if a financial advisor is right for you.

If you’re looking for a wealth manager and financial advisor that puts you first, call Ferguson-Johnson Wealth Management today!

CONTACT US