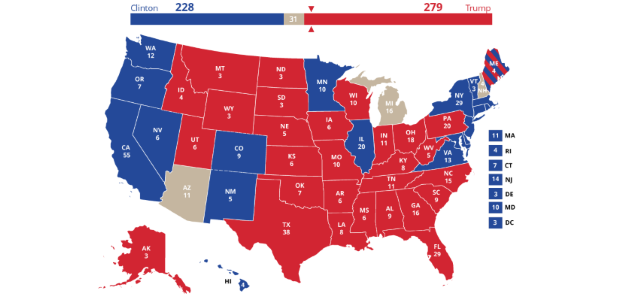

Donald Trump will be the president of the United States. The world is not ending. We got up this morning and we went to work. Some of us are a little happier than we were Tuesday.

Some of us are a little sadder. My job today isn’t to offer criticism or praise of the politics. I simply want to lay out a pragmatic approach for how most people should think about their portfolio, post-election.

The common belief among market insiders was that if Clinton won, equities would rise. If Trump won, markets were expected to fall, sharply.

Well, the S&P 500 posted a 1.11% gain on Wednesday and, as of this posting, markets are up significantly again today*. If we had fled markets, fearing a Trump victory, we would look rather foolish.

This illustrates why our investment philosophy does not try to time markets. Markets are unpredictable. Even when you think you know what’s going to happen, the market may not react how you anticipated. To beat the markets, you need to make too many decisions correctly in order to profit.

This is straightforward enough and it’s the reason why many people believe they can make money by picking stocks. Every one of us has successfully forecasted an event at some point in our lives.

You may have guessed that Apple would miss on its quarterly earnings. Perhaps, you correctly believed that the Brexit vote would pass.

You could have even had the foresight to predict a Trump victory. Unfortunately, for the aspiring stock-picker, this is only part one of the equation.

We like to assume that if we know, with certainty, that something is going to happen, we would also be certain of the aftermath. With markets, that isn’t necessarily true. Stocks can fall when they beat earnings (and vice versa).

As I mentioned before, the common belief on Wall Street was that a Trump victory would lead to a massive market sell-off. Instead, we saw one of the best days in the market for 2016.

Had you correctly predicted the election result and moved to cash (or worse – gold) you would be worse-off today than if you had taken no action at all.

Sometimes an event takes weeks or months to play out in the markets. The bear market brought on by the Great Recession lasted well over a year.

The Brexit resulted in sharp declines in the following two trading days. However, the S&P 500 went on to erase these losses in the subsequent seven days. It then went on to reach a record-high less than three weeks removed from the Brexit vote*.

In order to be successful in any action you take to time markets, you also need to determine when to close your position (or re-enter the market). Dodging a 5% loss doesn’t do you any good if you are also sidelined for a subsequent 10% gain.

Finally, we have to ensure that something else won’t happen to undo points 1-3. New developments that were not on your radar could erase the profits from an otherwise correct prediction.

For example, positive earnings from a stock can be undone by a weak jobs report that causes the market to sell off as a whole.

Now that we’ve laid out our investment philosophy’s foundation, let’s readdress what to do with your investments under a Trump Presidency: Be very careful about making bold adjustments to your long-term investment strategy.

Your investment portfolio should be built to be appropriate for your financial goals and overall risk appetite.

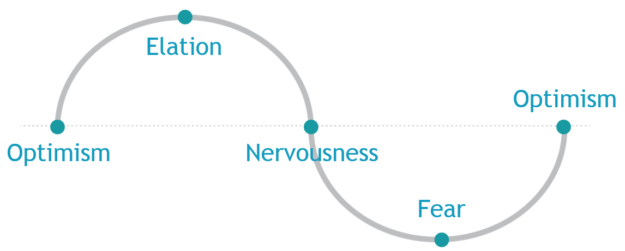

Investors are ill-suited to making decisions when driven by emotions. Any behavioral finance book or article will illustrate that we make adverse investment decisions when under the influence of euphoria or fear.

*Source: Morningstar

*Source: Morningstar

While you may feel confident in a belief of prosperity or recession under Trump’s Administration, you need to be right about too many other things in order to beat the market on that belief. In the end, it really just comes down to luck.

As we discussed last week, history has given us little reason to believe that a president or party controlling the White House can give us insight towards how markets will perform during their term.

Once you determine that it might be time to work with a financial advisor, it’s important to find the right advisor for you and your family. We’ve put together a guide of questions that are essential to ask an advisor before you hire them.

20 Questions to Ask a Financial Advisor

Don’t make a mistake by working with the wrong financial advisor. Ask the right questions the first time to determine if a financial advisor is right for you.

If you’re looking for a wealth manager and financial advisor that puts you first, call Ferguson-Johnson Wealth Management today!

CONTACT US